New 20% Tax Deduction for Asset Investments in New Zealand

The New Zealand Government has introduced a significant tax incentive aimed at encouraging business investment: a 20% deduction on eligible asset purchases.

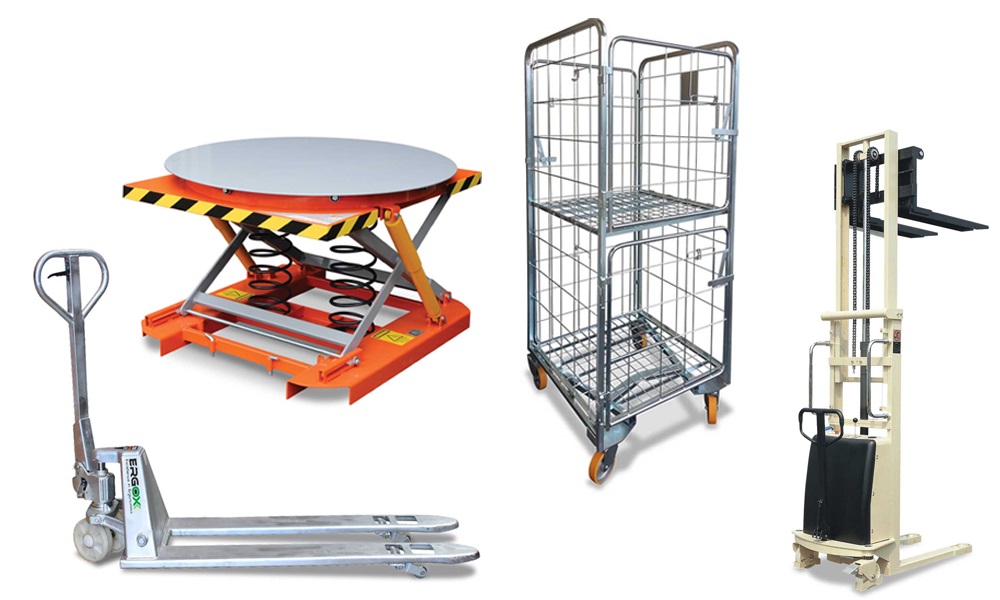

Known as the Investment Boost, this initiative applies to most new assets that are depreciable for tax purposes. This includes commonly acquired items such as machinery, equipment, and work vehicles.

Importantly, the Boost also extends to new commercial buildings, a notable change, as these typically do not qualify for depreciation deductions.

This tax deduction presents a valuable opportunity for businesses looking to upgrade or expand their operations.

Whether you're planning to modernise your premises or invest in advanced equipment, our team is ready to support you with:

- Site Assessment & Risk Identification

- Solution Engineering & Specification

- Comprehensive Project Lifecycle Management

- System Customisation & Integration

- Commissioning & Compliance Readiness

Explore how your business can benefit from this incentive in the NZ Budget 2025.

.png)